Analysis of Staple Food Price in Kenya

This is a simple visualization project on the prices of staple food commodities in Kenya since 2005. The commodities include;

- Refined vegetable oil

- Gasoline

- Cow’s milk

- Diesel

- Maize meal

- Bread

Loading the Dataset and Required Packages

library(dplyr)

library(tidyr)

library(ggplot2)

library(readxl)

library(htmlwidgets)

staple_food_prices_data <- read_excel("staple food prices simplified.xlsx")

Cleaning the variables; changing column types and deleting unnecessary columns

staple_food_prices<-staple_food_prices_data %>%

mutate(period_date=as.Date(period_date),

value=as.numeric(value),

value_one_month_ago=as.numeric(value_one_month_ago),

value_five_years_ago=as.numeric(value_five_years_ago),

value_two_years_ago=as.numeric(value_two_years_ago),

value_three_years_ago=as.numeric(value_three_years_ago),

value_four_years_ago=as.numeric(value_four_years_ago),

value_one_year_ahead=as.numeric(value_one_year_ahead),

value_one_year_ago=as.numeric(value_one_year_ago),

two_year_average=as.numeric(two_year_average),

five_year_average=as.numeric(five_year_average)) %>%

select(-c(price_type,unit,unit_name,unit_type,status,status_changed,

collection_status_changed,start_date))

Interactive Line Plot for the Products

plot<-ggplot(staple_food_prices) +

aes(x = period_date, y = value, colour = product) +

geom_line(size = 0.55) +

scale_color_manual(

values = c(Bread = "#A0522D",

`Cow's Milk (Fresh,

Pasteurized)` = "#00BFFF",

Diesel = "#000000",

Gasoline = "#FF0000",

`Maize Meal` = "#228b22",

`Refined Vegetable Oil` = "#FFA500")

) +

labs(

x = "Period",

y = "Value",

title = "Kenya Staple Food Prices ",

subtitle = "Prices since 2005",

color = "Product"

) +

theme_bw() +

theme(

plot.title = element_text(size = 16L,

face = "bold",

hjust = 0.5),

plot.subtitle = element_text(face = "italic")

)

library(plotly)

foodplot<-ggplotly(plot) %>% layout(yaxis=list(fixedrange=TRUE),

xaxis=list(fixedrange=TRUE))%>%

config(displayModeBar=FALSE)

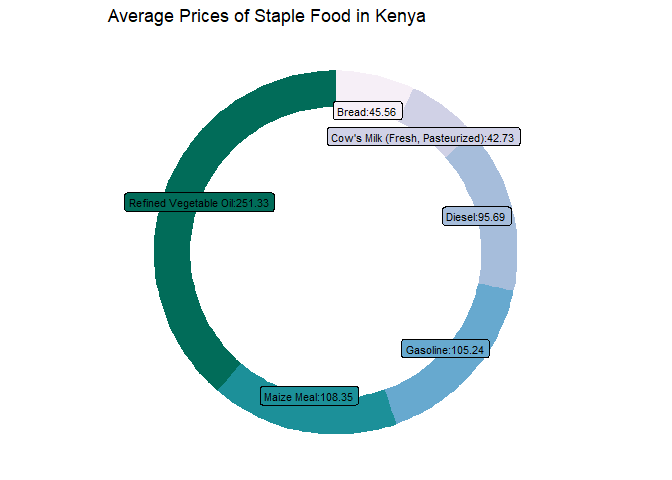

Average Prices of the products since 2005. This is visualized using a doughnut chart.

avg_prices<-staple_food_prices %>%

drop_na() %>%

select(product,value) %>%

group_by(product) %>%

summarise_at(vars(value), list(Average_Price=mean))%>%

mutate(ratio=Average_Price/sum(Average_Price),

Average_Price=round(Average_Price,2),

cumulative_ratio=cumsum(ratio),

ration_min=c(0, head(cumulative_ratio,n=-1)),

labelPosition=(cumulative_ratio+ration_min)/2,

label=paste0(product, ":", Average_Price))

ggplot(avg_prices,aes(ymax=cumulative_ratio, ymin=ration_min, xmax=4, xmin=3, fill=product))+

geom_rect()+

scale_fill_brewer(palette = 10)+

geom_label(x=3.0,aes(y=labelPosition, label=label),size=3)+

coord_polar(theta="y")+

xlim(c(-1,4))+

labs(title="Average Prices of Staple Food in Kenya")+

theme_void()+

theme(legend.position = "none")

Let’s select some few variables and transform our data set in to wider format. Wide format will help us compare the 6 commodities individually.

food_prices<-staple_food_prices %>%

select(period_date,product,value) %>%

mutate(product=as.factor(product))

food_prices_wide<-food_prices %>%

pivot_wider(names_from = product,

values_from = value)

food_prices_wide$period_date=as.Date(food_prices_wide$period_date)

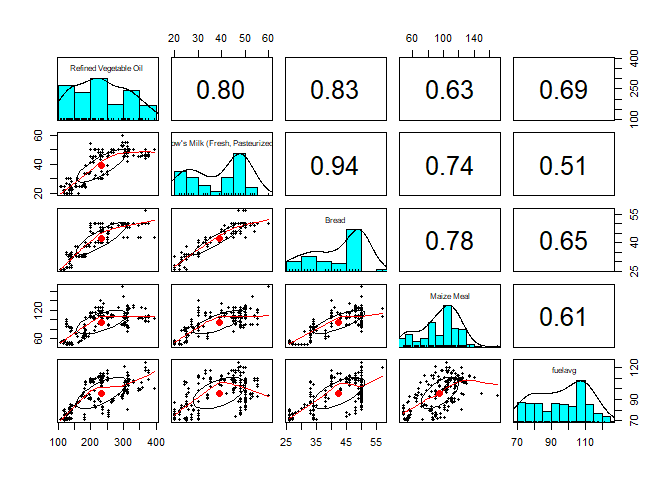

Fuel prices often affect prices of commodities. To check on this theory, we compute the average price of diesel and gas per observation and compute correlations with other prices. A correlation value above 0.5 indicate towards strong positive association.

library(psych)

food_prices_wide %>%

select(-period_date) %>%

drop_na() %>%

mutate(fuelavg= (Diesel+Gasoline)/2) %>%

select(-c(Diesel,Gasoline)) %>%

pairs.panels()

From the plot, all products indicate a correlation value of higher than 0.5. This confirms the claim that fuel prices in deed impact prices of other commodities.

Find the data and on my github reporsitory.